Unlock the 30-day secret to potentially making an extra $1,403 per month with a tiny account!

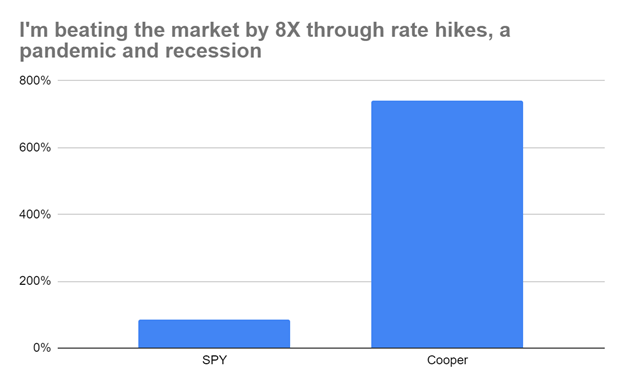

In fact, You could’ve made a total of 742% on your money doing exactly this the past 5 years.

(includes winners and losers)

I call this strategy “30-day trades” as you’re in and out in that timeframe with a win rate up to 82%!

I’ve been recommending trades for 5 years… in every market environment…And I’ll put my track record up against anyone out there…

30-day trades have been so successful because of one idea:. There’s money to be made no matter what the market is doing. By ‘going with the flow’, you can get in before a big move and, thanks to the short 30-day duration, get out before any moves against you.

- Ian Cooper 22-year expert trader (recommended up to 3,333% gains off the March 2020 Covid low)

|

What if you could make an extra $1,403 every 30 days?

You’re not getting rich, per se…

But you’re generating some extra cash to have and spend during these unprecedented economic times.

Now, that $1,403 isn’t a promise… it’s simply an average.

As you’re about to see… with many opportunities, you could’ve had months where you turned a few hundred bucks into thousands and thousands.

You don’t need any special skills.

Just patience and trust in a system that’s worked for years. My system.

“But these markets are different,” people tell me.

Here’s my response:

Money can be made in any market.

Anyone who tells you otherwise is lying.

The secret is knowing how to get in and out of trades before the tide turns too much against you.

That’s why I love what I call “30-day trades.”

You:

- Open a position tomorrow

- Within 30 days, you close the position

Done.

Do this 150-200 times per year…

And you’re making a lot of money.

The more 30-day trades you make, the more you can make as you have up to an 82% win rate doing it.

There’s no special software required.

And you don’t need to be some ‘expert trader.’

As early as tomorrow, you simply open up an email, follow the directions, find the ‘30-day trade’ and put it on.

Give me just 30 days and a handful of trades to show you how to make money consistently in the market.

If you don’t make any money in the next 30 days, you won’t hear from me again.

You’ve no doubt heard trading claims like this before from other so-called experts.

But I can promise none of them are able to show you the quick wins I can… in 30-days… with profits such as :

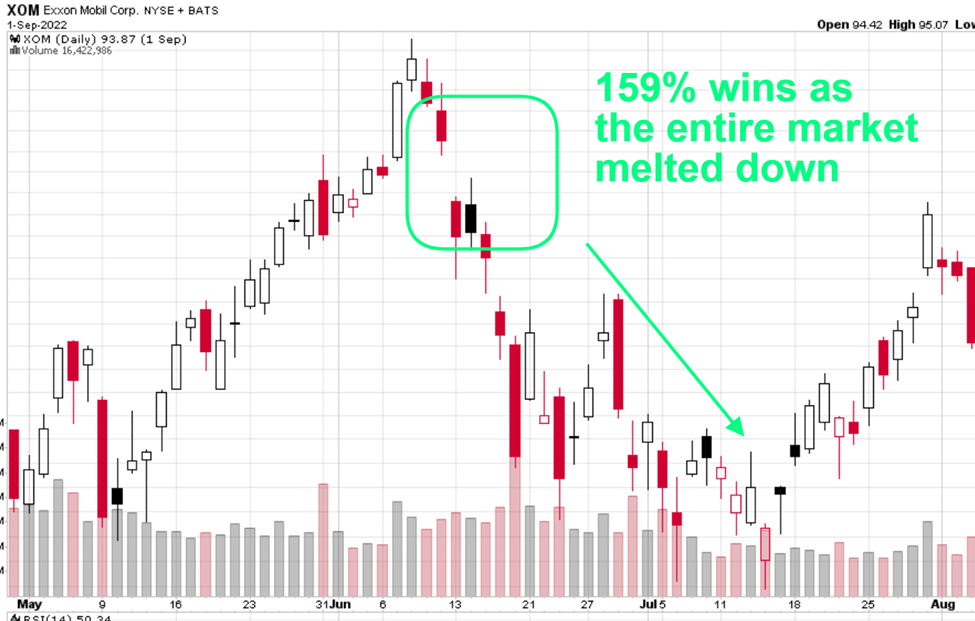

- 159% on XOM in 6 days

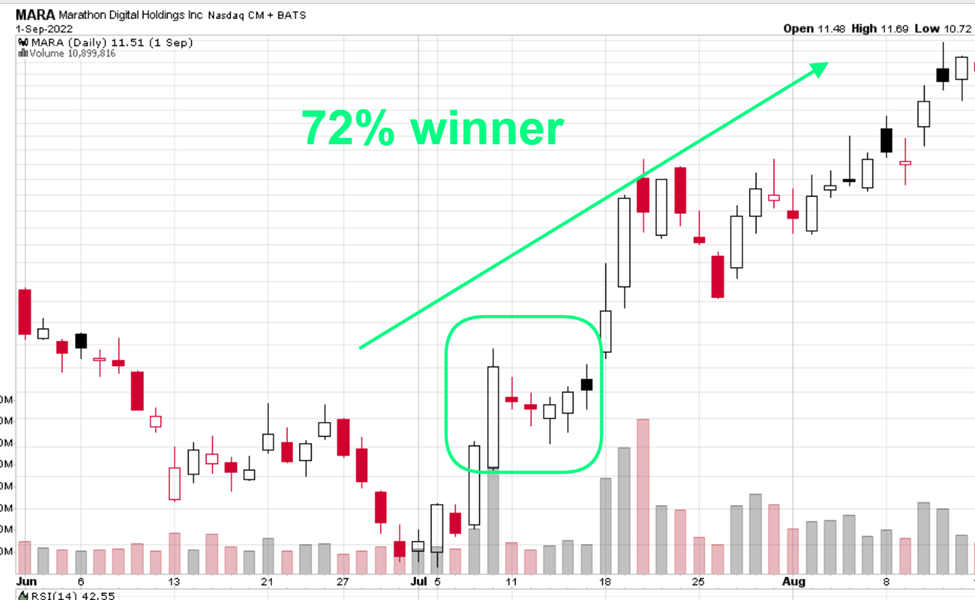

- 72% on MARA in 22 days

- 71% on JBLU in 7 days

- 129% on SPWR in 2 days

- 76% on DIS in 17 days

And, let me tell you…

These are just five of hundreds of trades I’ve recommended in the past 5 years.

All of them where you could’ve banked nice wins in 30-days.

Actually, you can sometimes open and close these trades in less than 30-days as I just showed you… but 30-days is what we shoot for.

That’s the amount of time you can expect to:

Invest as little as $75 and turn out potentially hundreds of dollars in a month.

Some trades, invest a few hundred bucks and make thousands!

If you invested $1,000 into the XOM trade I just showed you, it’s $1,590 in profit in 6 days.

Anyone can make these trades.

There’s no day trading. No sitting at your computer for hours on end.

Others, like David, are already making these trades.

Of course, nothing is guaranteed. I’ve recommended losers. No strategy works perfectly.

However, as you’ll see in the next few minutes…

These 30-day trades are working in every environment.

Bullish.

Choppy markets.

Or even blood-red crashing markets. The markets no one wants to touch.

I’ll share with you how I do it and more.

My name is Ian Cooper

If you have followed my 30-day trading strategy over the last 5 years…

You could’ve turned $10k into $84,223 following every single one of my trades

And an average of $1,403 per month starting with just a small account

That’s a 742% return on your money

That’s an average of 148% per year on average each year!

That beats the pants off the market returns.

The S&P 500 returned around 84% during the same timeframe.

742% vs. 84%.

And you don’t even invest your entire portfolio into my trades.

Just $10k would’ve turned into $84k.

$25k into $210k!

All from the quick 30-day trades I recommend.

These are real recommendations. No back tests or marketing tricks.

This includes investing in all winners and losers.

And anyone can start doing this in your account whether you’re at Schwab, TD Ameritrade, etc.

Listen carefully as this is something I’ll hammer home a lot on this page.

Follow this 30-day strategy consistently over and over again… you can make money.

Those who get too greedy, too picky, too scared… you miss out on the real money.

I’m never shy about my wins and losses.

In fact, every alert for one of my 30-day trades lists every single one of my trades in it. Winners and losers. I’m an open book about it all.

Because I have the experience in the markets to back it up.

Everyone’s a genius in a bull market.

What about when markets get rocky?

The way I trade keeps you on your toes… it makes you lock into the market. If you want to buy and hold stocks for 10 years, what I’m about to show you will make you feel queasy.

For years, I’ve shown a small group of active traders how to extract money from the market every 30-days with precision and accuracy.

Sure, every trade isn’t a winner. All won’t be.

But the track record I’ve compiled over the years has been one of the best in the industry.

That’s how you could’ve started with a mere $10,000… and turned it into $84,223 in the past 5 years.

That’s a 742% return on your money… including winners and losers.

You won’t find a track record like that anywhere.

I’m sounding a bit of a braggart and that’s not my intention. So forgive me if that’s how it comes across.

But it’s important you understand a track record like this is not normal.

And especially with how I trade.

I’m trading options for these 30-day trades

While others have an options win rate near 30%...

I’m at 70%...some years as high as 82%!

It’s taken thousands and thousands of repetitions to get to this point.

But I can claim that my options win rate is one of the best around.

Now, of course, this is where I have to slow down a sec and calm the crowd.

“Options! Those are so risky! You only lose money trading options.” That’s the normal pushback I get.

Well, I’m about to knock your socks off even more when I say --- Not only am I trading options… I’m buying options with these 30-day trades.

That’s even more of a cardinal sin, right?

Sure, you’ve heard of selling options with covered calls and the like. And that’s a great strategy.

However, I’ve discovered how to buy options and win over time despite having losers.

Because how I trade options is:

- Lower risk

- Higher win rates

- Quick, lower profits

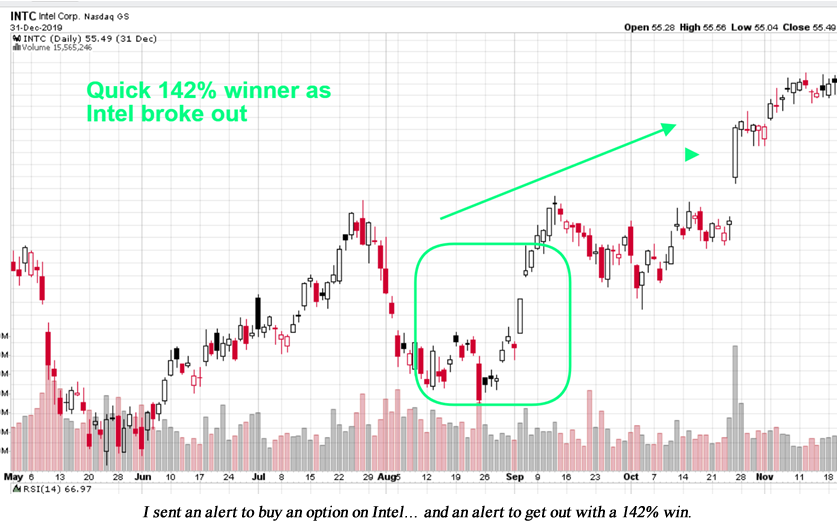

It’s how I’m able to spot a 142% winner when Intel breaks out.

I’m not buying at the bottom… I’m waiting until there’s a bounce then piling in.

Too many amateurs try to time tops and bottoms.

You can’t do that, especially with options.

Actually, many who trade options do a couple major things wrong.

Please don’t make any of these major mistakes

trading options:

- Amateurs shoot for huge, risky 1,000% wins.

Now, I’ll be upfront with you…

I’ve hit 1,000%+ winners before many times including 3,333% gains in 8 days on Amazon, 2,206% gains in 7 days on Google, and 1,056% gains on Netflix in 18 days.

However, I’m a professional. I’ve been at this for decades. I’ll share my background in a moment.

But, to hit these massive wins, it takes more risk, more swings, more research, plus lower win rates.

More importantly, it takes discipline.

And that’s where most options traders get wrecked.

They don’t follow rule #2:

- Only trade 1% of your account at a time. No matter how ‘hot’ your trades are going.

1% may only be $250 to you. You get a 71% win on Jet Blue, that’s $177 profit on $250. For many, that’s pretty good and you can buy a nice dinner for two.

However, as you get impatient, most rookies then crank that 1% to 5%, 10%, 20%!

Options, if you don’t know, aren’t like stocks.

Options have an expiration date. If the option is not at its strike price at expiration, it’s worth $0.

You could go out and plunk $25,000 onto an option that expires next week and lose it all in the blink of an eye.

I’ve heard of people it’s happened too. Someone who gets cocky and greedy.

I will never tell you to do that.

In fact, 30-day trades may sound like a get rich quick scheme… it’s not. Not even close.

Sure, you can bank some extraordinary wins like 129% gains on SPWR or 76% on META. But, in no way will I ever tell you to push all your chips in the middle on one trade.

I’m all about longevity if you plan to make a lot of money in the options space.

I’ve made a career out of it actually.

I’m a 22-Year Trading Expert & Designer

of this 30-Day Options Strategy

Again, my name is Ian Cooper.

Oddly enough, I got into trading options by accident. 22 years ago, I was working in public relations and marketing agencies, saying “great things” about companies I really couldn’t stand.

Can you imagine having to lie every time you went to work? It’s a terrible feeling and not the way I saw my life going.

Thankfully...

I was offered an editorial position with a financial publication I ran into. It was the best accidental meeting of my career and I ran with it.

For the next 22 years, I taught myself the ins and outs of trading, studying the strategies of billionaire investors, news flow strategies, as well as the art of technical analysis.

And I think I did pretty well.

In fact,

Over the last 22 years, I was one of the few that called:

- The bottom and top of the housing market before the Great Recession,

- The top of subprime mortgages,

- The death of Lehman Brothers and Bear Stearns,

- The collapse of the UK economy and

- The Dow’s collapse to 6,500, including its recovery.

I even forecasted gold to rally above $1,000 when it was trading under $850.

I’ve traded during rough times…

The end of 2018 when the market crashed on Christmas Eve…To the Covid drop…

And every single time, you could’ve made life-changing profits on the way back up

Those life-changing profit days are coming again very soon!

If you’ve been frustrated from the returns in the market…

This is NOT the time to sit on your hands and do nothing.

When the market hits a hard bottom (think a 2009 event or March 2020)...

And stocks start shooting back up into a new bull market…

You’ll bank some of the largest gains of your life.

For example, after 2018 closed with a market crash…

I recommended:

- LMT - gains of 130% in 1 day

- DIA - gains of 108% in 1 day

- CVX - gains of 115% in 1 day

And there were many more to follow after that, these are just an example.

After the 2020 Covid flash crash in March 2020 and the subsequent bounce back, you would’ve made these trades on Apple stock:

- 358% gains in 7 days

- 533% gains in 2 days!

- 310% gains in 6 days

Markets turning from bearish to bullish are the cream of the crop for traders.

As stocks recover from a rough 2022, we’re going to see more and more of these amazing trades popping up.

I’ve made a career of calling out great opportunities…

I showed you some of my past macro predictions like calling the drop of Lehman’s.

These are big predictions that put my name and reputation on the line. Yet, I didn’t stop there.

I Called Netflix at $10! Recommended Google after IPO!

Through the years, I’ve had some big stock pick winners:

- I recommended a buy on InterOil (IOC) at $20 a share. It would run to $400-- a 1,900% return.

- I recommended a buy on Visa (V) at $18. It’s returned as high as 1,129% returns.

- I recommended a buy on Alphabet (GOOGL) shortly after IPO and watched it race above for gains of up to 1,477%.

- One of my proudest recommendations -- Netflix at $10 -- raced almost 7,000% higher.

It’s why I’m one of the highest-rated, 5-star financial writers on the internet today.

Why share everything I’ve discovered…

Including opportunities at tens of thousands of dollars?

Because, like I said, I spent 20 years studying how the richest made their fortunes.

They have access to more opportunities to make huge windfalls… many more opportunities than you or I have access to.

That’s why I share everything with you.

Only a few thousand people will see these opportunities.

You won’t find me on CNBC or Bloomberg sharing these trades.

My trades aren’t for hedge fund managers. They are first for everything else.

No.

I trade for people like you. The person growing their income, you’re growing a nest egg to retire on.

I’m tired of the big guys raking in the spoils.

Not to mention, watching the big guys clean house on poor options traders who lose everything.

It’s frankly disgusting.

I’m fighting back.

However, due to how well my 30-day options trades work, I can’t broadcast everything to the world.

If millions traded my options recommendations, the market would tip over. Option prices would shoot to the moon and our advantage is lost.

Instead, I only want to share this with a small group.

You’re included, so listen closely.

The secret to my 30-day trading is my 365-degree approach.

What does that mean?

Find where the bullish areas of the market are

and jump in

Ignore the weak points of the market (no matter what)

Ever heard the saying, “There’s always a bull market somewhere.”

The problem with most investors is they pile into tech stocks in 2020… they do well…

But then they don’t know when to get out. They watch their 100% gains go to breakeven (or worse).

Sure, if you’re 25-years old, you can buy and hold for decades through the up and down rollercoaster we call the stock market.

But, when you get to my age, some of the big drops--- after you’ve seen huge gains --- are hard to stomach.

My goal is simple:

Find the bull markets.

To do that… you have to take a 365-degree look at the market.

One month we’re into Coca-Cola for a quick 55% win.

Next week, we’re buying Merck… and cashing in a 102% winner.

Then, a few weeks later, we’re jumping into Facebook:

And we bag a 182% winner.

$5,000 in would net a nice $9,100 in profit in under 30-days. That’s a nice vacation there.

Here’s the point…

We’re not forcing the market. You can’t force the market to do anything. Might as well try and try to change the direction of the ocean’s waves.

Instead, like a surfer, you ride the best waves, then find another.

Timing the market is impossible.

We’re not trying to time the market to make 1,000% gains.

We’re looking for proven, solid momentum and going with it.

Once you’ve done this for 30-years it’s pretty simple to spot.

What about when the market is in free fall?

How do we win?

During rough waters, I’m more cautious about putting on a trade.

But there’s still opportunities to bank 159% wins like I did in June 2022 as markets hit lows (at the time)

Over the past 5 years, when markets are falling out, it’s best to step back and let chips fall as they may.

During the March 2020 Covid-19 crash, I recommended 0 trades for 3 weeks.

Zero.

There weren’t any opportunities that stuck out bullish…

But there also was mass uncertainty, which I’m not interested in putting my toe into a pool of uncertainty.

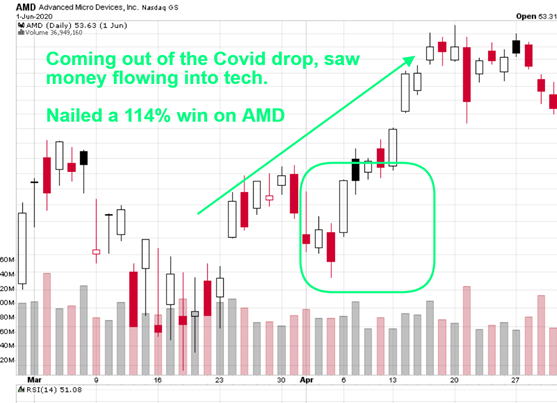

One of my first trades out of the Covid-19 crash was in AMD. I saw the Fed printing money and tech stocks bouncing hard.

You could’ve joined me for a 114% win. That’s a $1,140 profit on a $1k investment

Before that?

I wasn’t doing much trading until there’s some sort of bounce…

However --- there are times when there is a unique situation in a corner of the market I’ll take a nibble at.

Like as the markets cratered in June 2022…

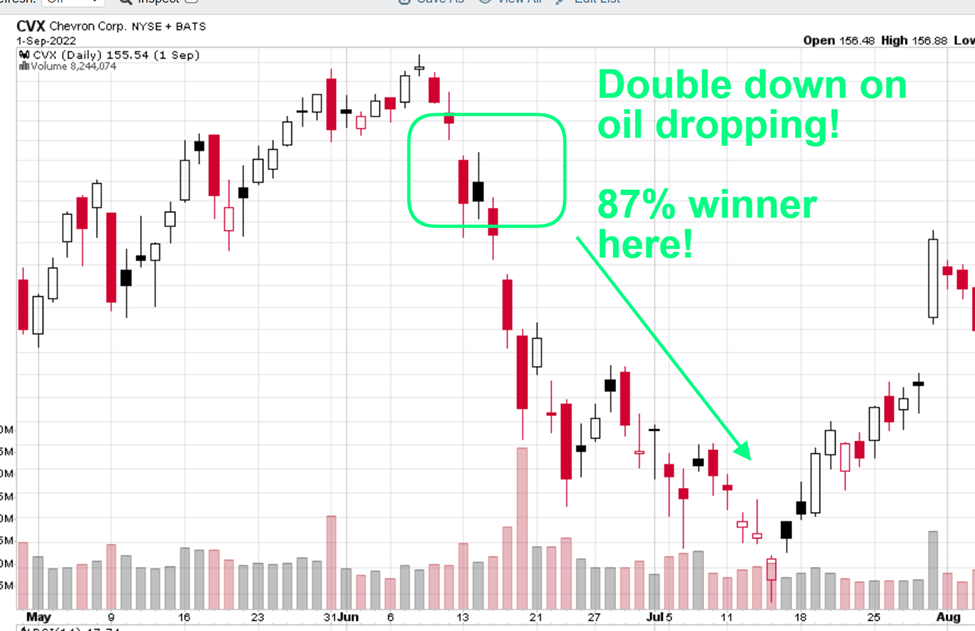

I saw not one… but two plays to make in the oil sector.

One that bagged a 159% winner while the stock cratered…

Another in Chevron for a 87% win.

Now, let me say again, when markets are melting down like they did in June 2022…

I’m not as active in the market.

Here, I saw oil was seeing a huge-run in price. There was mass turmoil with average Americans as filling up your car suddenly cost double what it did last year.

Gas prices in California were running to $6+/gallon.

Headlines like this spell massive moves in stocks

These types of ‘euphoric’ moments are excellent opportunities to go against the grain.

Again, as markets meltdown, it’s best to stay out of the way, but this opportunity was too great to pass up.

We nailed two huge winners.

In that instance, I was watching oil.

But it can be any sector that this works in.

Look for the bull markets… look for momentum.

What about materials like gold? What about assets like Bitcoin?

I’m looking at those opportunities too.

In 2022, Bitcoin was cut in half.

Near the end of summer, despite Bitcoin having cratered, I nailed this 72% winner on MARA.

MARA has crypto holdings, so it swings when Bitcoin moves.

And I was right.

In this instance, Bitcoin had seen a massive drop… but was consolidating and looking to make a move upwards.

Meanwhile, other parts of the market floundered…

Bitcoin was staying resilient and you could’ve capitalized with me.

The key is always keeping your eyes and ears open for big bounces. Find where the market is hot and go there.

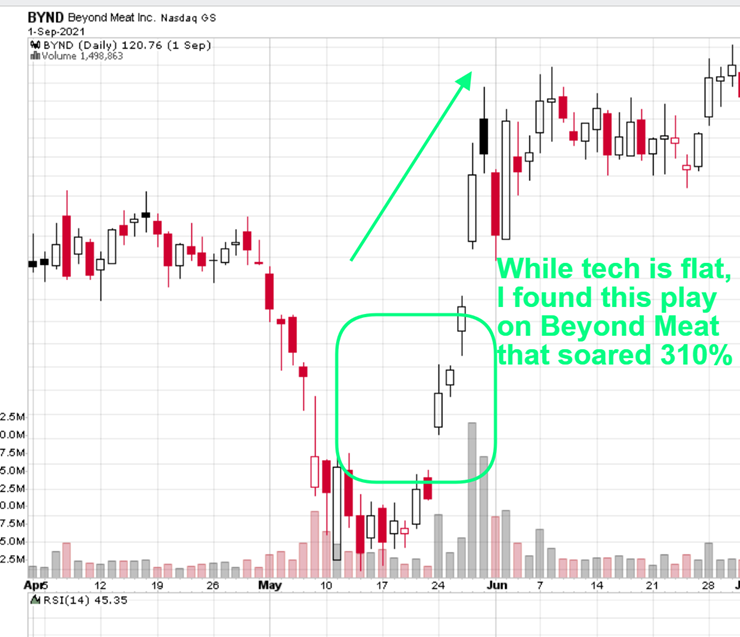

In 2021, tech stocks started showing weakness.

Yet, Beyond Meat was upgraded to “outperform” and the stock started moving.

I jumped on the opportunity.

Check out how well we did:

Imagine enjoying a 310% winner on a play like this.

Your significant other would beam with pride.

With the trade in May, you could be paying off your summer vacation in one swoop.

That’s $6,200 in profits on just a $2k investment in the options trade. All under 30-days from start to finish.

You could book a nice cruise for the family and you to soak up the summer sun with that quick cash.

But you don’t have to sit on your hands waiting for these plays to come to you.

I’ll bring them to you.

Even in a choppy market like 2022…

You could still have enjoyed a 129% winner on SPWR from a 30-day options trade.

Solar stocks saw some momentum as the Russia-Ukraine war commenced.

Again, there’s always a bull market somewhere… and it was in solar that day.

In 2021, money started moving out of tech and into boring stuff like industrials and materials.

So I wished my tech trades a ‘farewell’ for a bit and jumped into US Steel (X)

Worked perfectly for a quick 69% winner in under 30-days.

Not bad as many tech stocks like Zoom lost 15% (with more losses to come).

Like I said, I’m not sticking around tech trying to turn water into wine.

I don’t force trades. I like trading tech better than steel… doesn’t matter. I don’t fight the market.

The market does what it wants. I’m simply a passenger on its bus ride.

This is why these trades work in ANY market.

You are too no matter what you think.

When tech is not in favor, it’s best to look elsewhere.

When it IS in favor… you collect.

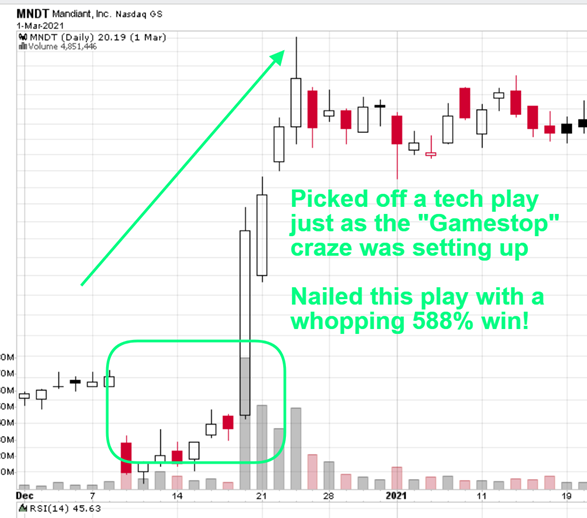

I got into Mandlant just days before the Gamestop mania in January 2021.

Take a look at this winner…

One of the biggest I’ve had in my 30-day trades with this strategy…

A 588% monster.

$2k investing is $11,760 in profits!

That’s a tidy profit to go invest in other stocks, buy something for yourself, sock away for a rainy day, or continue to build your nest egg.

That’s the beauty of 30-day options trades:

You’re not tying up your money for months and years.

It’s in and out. Yes, it’s that simple.

Sometimes, we’re buying options on stocks that get oversold.

Like in 2022.

Many companies cratered to kick off 2022…

But no stock just goes down, down, down forever. Eventually, they have a relief rally.

You can either sit in cash and get eaten up by 8% inflation…

Or, dip your toes in with a few 30-day options trades…

Only invest 1% of your portfolio in each trade…

And ride 64% gains on Pfizer like we did here.

These choppy markets can be tricky to play. But I’m looking for momentum and turnarounds.

I’m here to help you with that.

What about when the market’s smooth sailing?

The Fed’s printing money, everyone’s doing well… markets are soaring…

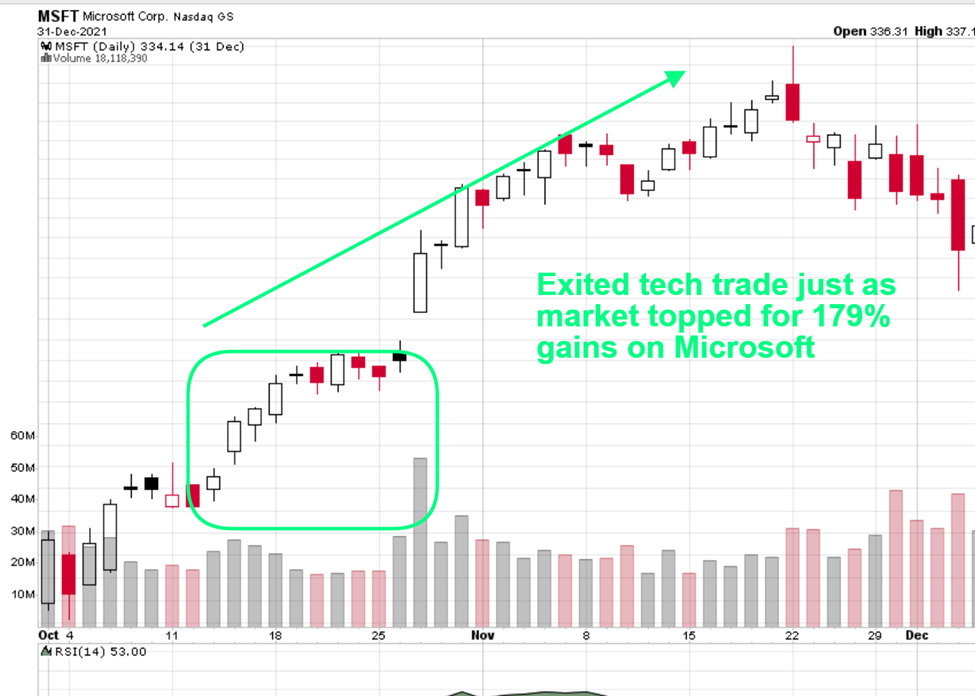

Well, that’s what the narrative was to close out 2021 before the Fed announced rate hikes.

So we rode Microsoft up, up, up for a 179% win and got out just as the market started topping out.

If you’re keeping score, that’d be a $1,790 profit on a $1k investment.

Again, I have 5 years of trades just like this working in every environment.

In the grand scheme of things, $1,790 isn’t a ton of money…

But do that again and again, then you have something.

Remember, the key with these 30-day trades is consistency over time.

Yes, I have losing trades.

In 2022, I had losing trades on:

- Amazon

- Dollar General

- Target

- Microsoft

Every trade isn’t a winner.

Some of these trades I lost 55%. Others 100% of my investment.

That’s why I only recommend 1% of your portfolio MAX into each trade.

Some may go to zero.

However, my track record over 5 years has you turning $10,000 into $84,223…

That includes winners and losers.

That’s riding the Fed wave, fighting a pandemic, seeing stocks soar, then crash at the worst pace since 2001.

My trading record has stayed firm.

My strategy hasn’t changed.

I’m not here today with a tech strategy, then tomorrow a cryptocurrency ‘guru, etc.

So many wannabe traders out there jump from one trading strategy or asset to the next. They trade options today, day trade stocks tomorrow, buy into crypto coins next week.

Not me.

I trade the same way… but I’ll only jump from one hot sector to the other. My strategy stays consistent. How I open and close trades stays consistent.

That’s how you win in short-term trading. You ride the momentum of what’s working in the market and forget the rest.

Trading options can be a highly emotional strategy

It’s very difficult to do alone.

Your option prices can swing wildly back and forth. It’s easy to be up 25%, see the profit go down to 10% in a few minutes and quickly click “SELL.”

No one is immune to these types of emotions.

I can say, FINDING great options trades is extremely difficult. Having to do that plus balance a trading account is virtually impossible.

So, I take a different approach.

Sure, I do some active trading myself with my money.

But I can’t provide you the very best trades if I’m also trading at the same time with the same recommendations.

That’s why I do what I love --- study the charts, study the volatility in options, and bring you the opportunities.

You can then take advantage like Keith did:

If you’ve never bought options before, what I’m sharing with you won’t make sense.

I promise…

Once you take that step into the ring and start trading alongside me, you’ll understand the feeling.

Watching someone ride the bull is NOT the same as actually riding the bull yourself.

I’m here to be your coach in your corner.

When you enter a 30-day trade, there will be days where you see your trade be negative. Maybe even negative 99%.

That’s never a good feeling.

But…

If you trust the process… and I have a 5-year public track record… through bull markets, a pandemic, choppy markets, and crashes…

You can win in the end.

That’s what I want you to focus on.

Again, let me be clear…

If you decide to try options trading yourself. You want to find your own trades based on the tips I share here…

You’ll quickly find how difficult it is to manage your own trades, find new trades, and stay profitable over the long haul (while keeping your emotions in check).

You can try. Leave this page and go do this for yourself.

I’ve watched traders for 30+ years try and win at this. It’s extremely difficult. Almost impossible. There’s a reason most retail traders underperform the market.

For a small fee… I can help you every single week with your trades.

To start making these ‘30-day trades’

Start with Trade Alert 365.

I take a 365-degree view of the market to find the strongest sectors today.

So we’re only trading in opportunities that have momentum and can pay us every 30 days.

The goal of Trade Alert 365 is easy ---> Hand to you… on a silver platter in your email… trades from all over the market.

You could be trading tech this week…

Oil the next…

Materials, consumer goods the week after.

My #1 job is to search for opportunities for you. I share the entry point and send you an email when to exit.

It’s that simple.

Everything is right in your inbox.

No special log-in required.

Trade Alert 365 is an emailed trade update 3-5 per week.

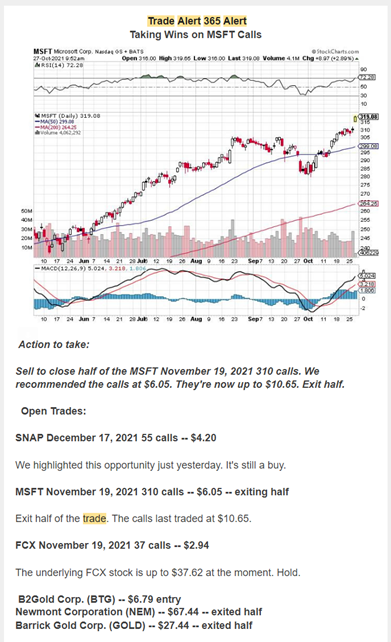

I send you an email with an opportunity that will look similar to this:

I share an “Action to take”, what I’m looking at, the chart itself…

But I don’t stop there.

You’ll see other trades open at the moment… and sometimes we have a bunch…

At the bottom, I post EVERY SINGLE TRADE I’ve ever recommended in Trade Alert 365.

That’s right.

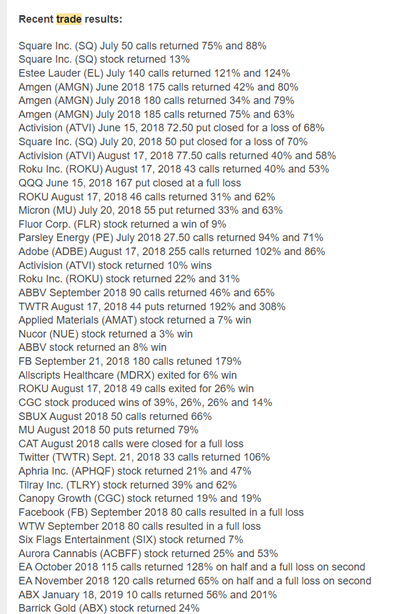

Here’s just a peek.

I’m not going to post the entire thread as it’s hundreds of trades.

However, when you join Trade Alert 365, you’ll see the track record in full inside every email.

Take a look again. The list starts in 2018 when I started the service.

You’ll see 308% wins on Twitter… but I also share where I took a full loss on WTW. It’s all there. Completely transparent.

Why share in every email?

For two reasons:

#1. You’re busy and not always going to remember who I am and how well my trades have worked.

But also… more importantly…

#2. You remind yourself to stick to the process.

There’s 5+ years of trades in there. You’ll see we are constantly winning again and again.

We will have losses. Sometimes it’s a 100% loss. Part of the process is you follow my quick trading rules… especially to never trade more than 1% of your account in each trade.

This track record is a constant reminder to stay the course.

I hope you’re with me inside Trade Alert 365 for years to come. I have subscribers who have been there with me since the beginning.

This service isn’t going anywhere.

WHAT YOU GET AS A MONTHLY SUBSCRIBER TO

TRADE ALERT 365:

- 1-5 trade alerts every single week. It all depends on market conditions. Some markets, we’re more active.

- We buy calls AND puts. So this works in every market.

- The exact option to buy. That includes the strike price, expiration and roughly what the options price is.

- Each email has an ‘open trade’ section with each current trade open. Right when you join me inside, you’ll receive your first email soon to see my current trades.

- Alerts to close a trade and at what price to close at. This is what you need. I’m here to tell you when to hold a winner/loser, and when to get out of a trade for a win/loss.

To join Trade Alert 365, I only offer a month-to-month subscription.

You’re never locked into a 1-2 year commitment.

Join now, try it out for 30-days… and, like I said at the top, if you don’t make money, cancel and never hear from me again.

It’s that easy.

No high-pressure sales pitch here.

You can make money in good and bad markets or continue doing this on your own.

The price?

For many options products, you’re paying $2,000. Heck,

I’ve seen $4,500/year.

For Trade Alert 365?

One payment now of just $1.

That’s it.

What’s it cost to start receiving these ‘30-day’ options trades?

$1.

Get all my trade alerts… my entire track record… everything.

If after 30-days, you enjoy what I’m sharing, it’s $29 each month until you cancel.

Say I send you a normal trade in US Steel.

We nail a 69% winner.

You put in 1% of your portfolio.

Say that’s just $250 invested in the trade.

69% profits would yield a $179 return.

That’s 179X more than what I’m asking for now from just ONE TRADE.

I’m not trying to get rich here. I just want to help.

The hope? You stick around for years to come, you join my other products and you finally have someone who you can trust with your trading.

Start now for just $1.

If you do, I have one bonus to share:

BONUS:

Get stock recommendations to buy

inside Trade Alert 365

Sometimes options don’t make sense for an opportunity I find.

Maybe the play doesn’t trade options.

Other times, the opportunity is more a long-term look.

There aren’t a ton of these inside Trade Alert 365, but it gives you a chance to deploy more capital without taking big bets on just our options trades.

Because we will have hot streaks. Sometimes we’re hitting 5-7 trades in a row as winners.

However, you should always stick to the rule to never trade more than 1% of your account in each options trade.

It shields you from whenever we do have a losing trade.

I add in opportunities to buy stock so you put more money into the market at a much, much lower risk.

And it’s paid off.

I’ve showed stock wins (not options) to readers on:

- Tilray = 62% stock gains

- 1-800 Flowers = 18% stock gains

- Newmont Mining = 12% stock gains

- Apple = 15% stock gains

- Etsy = 19% stock gains

- AMD = 20% stock gains

- Alpha Pro Tech = 73% stock gains

I’ll give you stock ideas in addition to your options trades. All for FREE inside your Trade Alert 365 emails.

No other portal or email to receive. It’s all there in your email alerts!

Trade Alert 365 is the perfect product to start actively trading and seeing success.

You’ve seen my 5-year track record through good and bad markets.

I’ve traded options for 30+ years. I’m here to help.

Help yourself today for a mere $1.

Heck, it’s also a lot of fun once you start ripping off some winners. Come see for yourself.

Put in your information below and join Trade Alert 365 and join hundreds of others now.

Your first trade alert will be in your email as soon as tomorrow.

Keep a lookout. First, put in your information and join now.

FAQ:

How much money do I need to trade with Trade Alert 365?

Option prices for our trades are low, so you don’t need even a few hundred bucks to dip your toe in. To start comfortably, I recommend $5,000 to put aside. Up to $10,000 if you can.

Options are risky, aren’t they?

For traders who don’t know what they’re doing… yes, options can be tough. I’ve been doing this for decades. I’ve shown you my track record. And that track record was for just one strategy! I have multiple strategies with similar high win rates and multi-year success rates. The key is following the rules and using proper money management. Just because you have a huge win, doesn’t mean the next one will be huge too and to put all your chips in the middle.

This isn’t a ‘get rich quick’ strategy. It’s a compounding strategy over time.

What’s your win rate for these 30-day trades?

Over 5+ years, 70%... with some years up to 82%.

How much to join Trade Alert 365?

$1 for 30 days access. After 30 days, it’s another $29 each month until you cancel. No contracts or terms.

What can I expect when I join?

1-5x per week (depending on if the market is behaving), I’ll send you an email with:

- The trade to make today

- Our open trades (and whether to close them)

- My entire track record over many years (so you can see how we’ve done in the past)

There’s no complicated software to use. No phonecalls to attend.

Can you put aside 5 minutes to read one email? That’s all that you need then take the right action.

How much can I expect to make trading your strategy?

Hard to answer that as I don’t know your starting amount. Over 5 years, we’ve averaged 148% gains per year. If you start with $1,000… you could’ve averaged banking $1,480 in profit. That pays for almost 5 years of Trade Alert 365 right there.

Nothing is guaranteed and future results aren’t promised even with my track record.

Is there a refund period?

Since this is a 30-day, cancel-anytime, no contract service, there are NOT opportunities to refund. Your first trade should be worth hundreds compared to the single dollar you paid.

What if I don’t know how to trade options?

It’s simple. First, get clearance to trade Level 1 options. It’s the easiest options to get approval for. Call your brokerage or request access online.

Then, I give you the exact option to buy.

All you do:

- Go to the Ticker Symbol

- Find the options chain

- Find the expiration date (very important --- I usually do an option 30-60 days out)

- Find the strike price (I share this in the email)

- Fulfill the order based on how much you want to invest. (I recommend starting with just 1 contract until you feel comfortable)

Take a few moments and get acquainted with your brokerage’s option’s chain. Buy a cheap option to see what it’s like for a few bucks. I promise you’ll be able to do this whether on your computer or your phone.

Your first trade could be in your inbox tomorrow.

Join Trader Alert 365 below now for just $1.