|

WIN Weekly Income Now Just What You’ve Always Wanted |

|||

ENROLLMENT ENDS Sunday, May 18 10:00 PM EST |

||||

Check out this amazing testimonial email we received yesterday:

From: Elliott C

Sent: Friday, May 16, 2014 1:15 PM

To: kim@tradewins.com

Subject: Re: I’m afraid you must decide today because…

Dear Chris,

I appreciated what I saw in the WIN videos. It was an eye opener to say the least. I have been trading off and on since 1999 - mostly options. The approach you have developed is one of the best I've seen in quite a while, and I have seen several and tried several.

I wanted to share what helped make my decision to subscribe to your service, which I did yesterday, May 15. I picked up on, in one of the videos or your emails - probably an email - the post-earnings trade that had worked so well with GMCR (over 1,000% profit). As I read about that trade on Monday May 12, I pulled up a chart of GMCR and noticed something that I took action on immediately at 9:50 EDT. Most people would have thought the trade was over with GMCR by then. After the earnings gap last Thursday, with explosive follow through, followed by another solid day up on Friday May 9, I noticed the candle stick that was forming on Monday May 12, compared to the previous two candles, was essentially a doji. In this case, "obvious was a function of familiarity", a phrase you adeptly coined this week's newsletter which I just read as a new member. I recognized a very high probability that a doji sandwich was setting up. Though there were two large bullish candles on the 8th and 9th, that doji on the 12th let me know that GMCR was not finished moving upward and that the probability for that doji sandwich formation was as near 100% as it gets. A doji sandwich is a large bullish/bearish candle, followed by a "doji" the next day, then followed by another bullish/bearish candle the third day to finish the "sandwich" formation. The body of the candle on the third day is essentially equal in length to the body of the candle that starts the sandwich formation on day one.

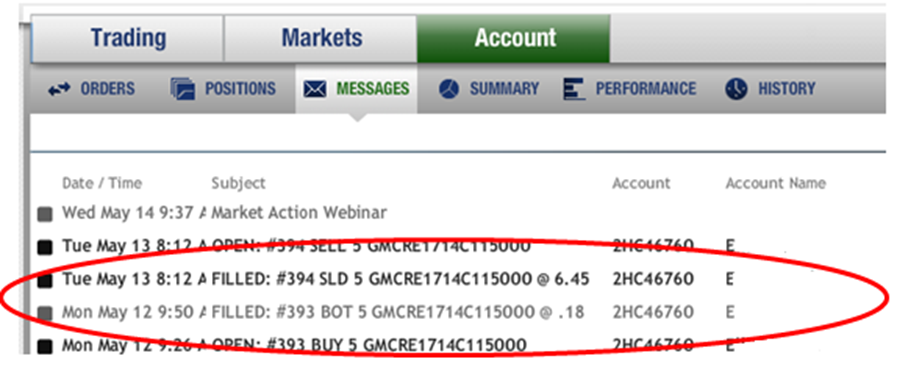

I bought 5 of the weekly May 16 $115 Call options at $0.18 when the stock was at $108.70. I figured $90 would be a nice experiment on the principles you shared with very little risk. It was impossible to know that on May 13, the very next day, Coca Cola announced an increase in its ownership of GMCR from 10% to 16%. Not only did the doji sandwich form as expected, but that news gave it an extra unanticipated boost. I expected a move the next day from about $109 to $113.50 with the "third day" candle, since the day before the doji, GMCR had moved in price from $103.88 to $108.47 ($4.59). I was very fortunate to have the price move on May 13 from a close on May 12 of $110.71 to a high on May 13 of $123.62. Of course you know what happened to my Calls. I knew GMCR was facing resistance at $123.74 from a previous top out in February. So when the stock hit $122-ish, I sold the $115 Calls at $6.45 for a one day 3,483% profit!! My $103 investment (plus commissions) turned into a $3,212 payday! GMCR did sell off after hitting resistance at $123.62 to close that day at $112.97.

You can add this to your list of testimonials if you wish. I am looking forward to your service to say the least! I've attached screen shots of my TradeMonster messages and history proving I actually did this trade. The May statements are obviously not available yet, so the screen shots will have to do.

I am sorry your wife spent time in the hospital last week. I hope she is doing better.

Kindest Regards,

Elliott C

IMPORTANT: Watch this ENTIRE VIDEO now for registration

information and learn how you can get a free gift worth $4,195.

Option and stock investing involves risk and is not suitable for all investors. Only invest money you can afford to lose in stocks and options. Past performance does not guarantee future results. The trade entry and exit prices represent the price of the security at the time the recommendation was made. The record does not represent actual investment results. Trade examples are simulated and have certain limitations. Simulated results do not represent actual trading. Since the trades have not been executed, the results may have under or over compensated for the impact, if any, of certain market factors such as lack of liquidity. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

NOTICE: This testimonial was provided by subscribers to Chris's various products without compensation. Chris Verheagh believes they are true based on the representations of the subscribers but has not independently verified them, nor have photos been authenticated, nor has any attempt been made to determine the experience of the individuals after the testimonials were given. They may have been given in reference to one of 's products or services - not necessarily WIN. Past results are not necessarily indicative of future results. People can and do lose money trading options.