Delta for Each Strike Price

By: Wendy Kirkland

The following is an excerpt from Wendy Kirkland's Price Surge System Manual

Each strike price incorporates a delta percentage number that is used in the calculation of its option premium. The deeper in-the-money (ITM) an option is, the higher the delta. Delta is one of the Greeks that play a part in option pricing.

You want to avoid the lure of an inexpensive option that is too far out-of-the-money (OTM). At first you assume you have found a great bargain, perhaps only $.16 per share, a total of $16 per contract. And you imagine getting 35 contracts for $576. But then, you check the deltas and find it is .09. For every dollar of the underlying asset’s price move, you get $.09 cents. You can see at that rate, it will take a long time for an option to cover the spread cost between the bid and the ask, plus the brokerage fees, much less ever get to the point where you realize a profit.

Therefore, we look to not only buy one strike out-of-the-money (OTM) or at-the-money (ATM), but the option should have a delta of .30 or better, preferably with a delta of .39 to .65. With that percentage or higher, you’ll make $.39 to $.65 or more for every dollar move of the underlying asset. Higher deltas have higher premiums.

With weekly options, the increase in deltas happens quickly. The delta might be .30 one day and after a small move, it could be .55 the next day and .80 the following day.

I have found that the greatest leverage happens on the option that is one strike OTM. Often this is the strike that would also be considered ATM. The delta is large enough to give you a nice increase as the equity price moves, but it also brings the delta up quickly, so that if your trade is working, the profits are compounded by delta and the large number of contracts that you were able to purchase.

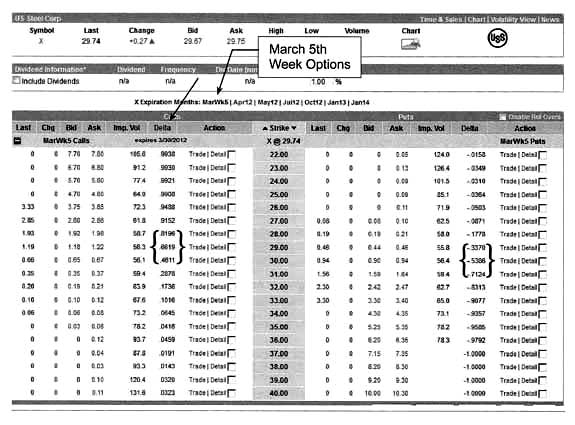

The image below is a chart showing the delta percentages for US Steel’s March 5th Week option that has 5 days until expiration. With the stock price at 29.74, the 29 strike price is .74 ITM and could be considered an in or ATM option. It has a delta of .6619. The ask premium price of $1.22 for the 29 strike call will move up .66 cents (rounded down) for every dollar move up in the stock’s price.

The 28 strike has $1.74 intrinsic value and is even deeper ITM. Therefore, the ask premium is higher than the 29 strike and so is the .8196 delta. The 28 strike ask premium of $1.98 will move up by .82 cents (rounded up) for every dollar move up in the stock’s price.

The 30 strike is OTM by .26 cents; therefore, has no intrinsic value. Its delta is .4611 and as the stock’s price moves up, so too will the ask premium by .46 cents for every dollar move. You will note the further OTM that the strike is the cheaper the premium price and, also, the lower delta. Especially, when it comes to a short term day trade, you’ll want your option to gain quickly, to move .30 to .65 cents per dollar move in the stock’s price rather than only .30 or less.

On the lower right of the chart, you will find the put option information. For put options you expect the stock’s price to go down or decrease. Therefore, the further OTM the strike is the more valuable. The ask premium of $1.64 for the 31 strike has a higher delta of .7124 and is more expensive than either the 30 or 29 strike.

Sometimes new traders have trouble understanding the concept of puts or the essential difference between calls and puts.

The two examples below are fictitious and not based on the option chain information, or on any specific stock, but instead are numbers that are easy to multiply and follow.

CALLS: Give the option trader the opportunity, but not the obligation, to buy the stock for the strike price and sell it for (hopefully) the stock’s current higher price.

Example: You’ve bought the call strike price of 25 for $1.25 ask premium with a delta of .66 and sell for an increased stock price of $27, having increased in price by $2. Now most traders seldom, if ever, actually take possession of the shares of stock. The buy and sell transaction happens behind the scenes at the brokerage and you just receive the profits from the option transaction.

So if you paid $1.25 ask premium (total investment of $125 for the 100 share option contract) with a delta of .66 and the stock price increased $2, the option would increase by $1.32 ($2 times .66). The ask would now be $2.57 ($1.25 + 1.32) and the bid price a little lower by the spread (cost of handing the transaction), let’s use a .10 cent spread, so you could expect the bid or the amount you would receive when the option was sold to be about $2.47 per share or $247 for the option contract of 100 shares.

Pretty good trade. You paid $1.25 and received $2.47 per share or a gain of $1.22 (98%) or $122 for the 100 share contract.

PUTS: Give the option trader the opportunity, but not the obligation, to buy the stock for the current stock price and sell it (hopefully) for the higher strike price.

Example: You’ve bought a put strike price of 26 for $1.15 ask premium ($115 total investment per option contract) with a delta of .56 and stock’s price drops to $24, having decreased in price by $2. Now, again, most traders seldom, if ever, actually take possession of the shares of stock. The brokers handle the option transaction.

So now the stock’s price is $24 and you paid $1.15 to sell at the strike price of 26. So behind the scene’s the broker will buy the stock for $24 and will sell it for $26. Your option has a delta of .56, so your premium increased by $1.12 ($2 times .56). The ask would now be $2.27 ($1.15 + 1.12) and the bid a little lower by the spread (cost of handling the transaction), let’s use a .10 cent spread again, so you could expect the bid or the amount you would receive to be about $2.17 per share or $112 profit for the option contract of 100 shares.

Another nice trade! You paid $1.15 and received $2.27 per share or a gain of $1.12 (97%) or $112 for the 100 share contract.