Options: Price Tables & Terminology

By: Dan Keen

The following is an excerpt from Dan Keen's Covered Call Writing: A Low Risk Cash Flow Money Machine

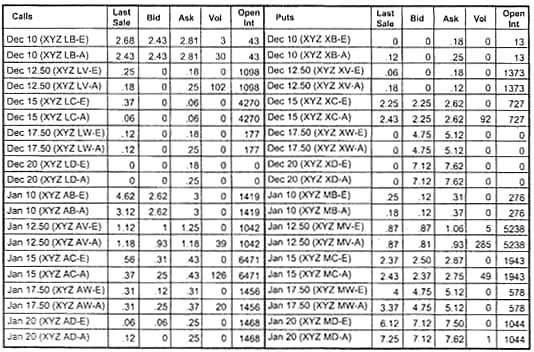

The table below is called an option “class” listing; it is a group of calls or puts on the same stock. Each horizontal row is an option “series”, showing the prices for calls or puts for a particular option having the same strike price and expiration date. This listing is for our hypothetical XYZ Company. The group on the left is information on call options; put options are on the right.

Option Class Listing for XYZ Company

Let’s examine the first row, Dec 10 (XYZ LB-E). The month and the strike price are indicated by “Dec 10”. Don’t be confused thinking “10” is a date – it is the strike price. The day of the month is not given, as it is always the third Friday of the month.

Next, the symbol “XYZ-LB-E” specifies the underlying stock, in this case the XYZ company, “L” is the month (December), and “B” is the strike price ($10). You can find the “L” symbol on the table below.

CALLS |

|

PUTS |

||

MONTH |

CODE |

|

MONTH |

CODE |

January |

A |

|

January |

M |

February |

B |

|

February |

N |

March |

C |

|

March |

O |

April |

D |

|

April |

P |

May |

E |

|

May |

Q |

June |

F |

|

June |

R |

July |

G |

|

July |

S |

August |

H |

|

August |

T |

September |

I |

|

September |

U |

October |

J |

|

October |

V |

November |

K |

|

November |

W |

December |

L |

|

December |

X |

And the corresponding strike price “B” can be found on the following table showing strike prices and codes.

STRIKE PRICES |

CODE |

|

STRIKE PRICES |

CODE |

||

5 |

105 |

A |

|

70 |

170 |

N |

10 |

110 |

B |

|

75 |

175 |

O |

15 |

115 |

C |

|

80 |

180 |

P |

20 |

120 |

D |

|

85 |

185 |

Q |

25 |

125 |

E |

|

90 |

190 |

R |

30 |

130 |

F |

|

95 |

195 |

S |

35 |

135 |

G |

|

100 |

200 |

T |

40 |

140 |

H |

|

7.50 |

37.50 |

U |

45 |

145 |

I |

|

12.50 |

42.50 |

V |

50 |

150 |

J |

|

17.50 |

47.50 |

W |

55 |

155 |

K |

|

22.50 |

52.50 |

X |

60 |

160 |

L |

|

27.50 |

57.50 |

Y |

65 |

165 |

M |

|

32.50 |

62.50 |

Z |

The first three letters of the option symbol will not necessarily be the same as the ticker symbol for the underlying stock. Obviously, some stocks have more than three letters in their ticker symbol, such as those found on the NASDAQ exchange. Sometimes the letter “Q” is also used as an ending character when shortening symbols. For example, the ticker symbol for Staples is SPLS. The June $22.50 call option symbol is PLQFX.

The final letter “E” is not actually a part of the option symbol, but indicates the options exchange where that particular option is traded, such as the New York Stock Exchange, The American Stock Exchange, The Philadelphia Stock Exchange, and so on.

Other columns in a typical option class listing, as seen in the first table above, show the price of the last sale, the bid and ask prices, the volume, and the open interest (the number of option contracts currently held on that specific option).

For the purpose of writing covered calls, we will be interested in the “bid” column. This is the premium we will receive for writing a covered call.

Options are tools that give investors and traders more ways to enhance their income and protect stock holdings. Next, let’s define some option terminology.

Options are contracts which give the buyer the right to buy or sell an underlying stock. Buyers get rights, while sellers take on obligations.

- A call buyer has the right to buy.

- A put buyer has the right to sell.

- A call seller has the obligation to sell.

- A put seller has the obligation to buy.

Premium – A premium is the price paid by the buyer for an option contract, or received by the seller for selling a contract. The premium price of an option is made up of two parts: a time value and an intrinsic value.

Strike Price – The strike price is the price at which the underlying stock may be bought (or sold).

Expiration Date – The expiration date is the day on which the option ceases to exist; it is the last day the option can be exercised.

In-The-Money – An in-the-money call option is when the stock price is above the strike price.

At-The-Money – An at-the-money call option is when the stock price is the same as the strike price.

Out-Of-The-Money – An out-of-the-money call option is when the stock price is below the strike price.