Fundamental Trading Strategy: Intervention

By: Kathy Lien

The following is an excerpt from Kathy Lien's Day Trading the Currency Market

Intervention by central banks is one of the most important short-term and long-term fundamentally based market movers in the currency market. For short-term traders, intervention can lead to sharp intraday movements on the scale of 150 to 250 pips in a matter of minutes. For longer-term traders, intervention can signal a significant change in trend because it suggests that the central bank is shifting or solidifying its stance and sending a message to the market that it is putting its backing behind a certain directional move in its currency. There are basically two types of intervention: sterilized and un-sterilized. Sterilized intervention requires off-setting intervention with the buying or selling of government bonds. While un-sterilized intervention involves no changes to the monetary base to off-set intervention. Many argue that un-sterilized intervention has a more lasting effect on the currency than sterilized intervention.

Taking a look at some of the case studies, it is apparent that interventions in general are important to watch and can have large impacts on a currency pair’s price action. Although the actual timing of intervention tends to be a surprise, quite often the market will begin talking about the need for intervention days or weeks before the actual intervention occurs. The direction of intervention is generally always known in advance because the central bank will typically come across the newswires complaining about too much strength or weakness in its currency. These warnings give traders a window of opportunity to participate in what could be significant profit potentials, or to stay out of the markets. The only thing to watch out for, is that the sharp intervention-based rallies or sell-offs can quickly be reversed as speculators come into the market to fade the central bank.

Whether or not the market fades the central bank depends on the frequency of central bank intervention, the success rate, the magnitude of the intervention, the timing, and whether fundamentals support intervention. Overall though, intervention is much more prevalent in emerging market currencies than in the G-7 currencies since countries such as Thailand, Malaysia, and South Korea need to prevent their local currencies from appreciating too significantly such that the appreciation would hinder economic recovery and reduce the competitiveness of the country’s exports. The rarity of G-7 intervention makes the instances even more significant.

Japan

The biggest culprit of intervention in the G-7 markets in past years has been the Bank of Japan (BOJ). In 2003, the Japanese government spent a record Y20.1 trillion on intervention. This compares to the previous record of Y7.64 trillion that was spent in 1999. In the month of December 2003, between November 27 and December 26 alone, the Japanese government sold Y2.25 trillion. The amount it spent on intervention that year represented 84 percent of the country’s trade surplus. As an export-based economy, excess strength in the Japanese yen poses a significant risk to the country’s manufacturers. The frequency and strength of BOJ intervention during those years created an invisible floor under USD/JPY. Although this floor gradually descended from 115 to 100 between 2002 and 2005, the market still had an ingrained fear of seeing the hand of the BOJ and the Japanese Ministry of Finance once again. This fear is well justified because in the event of BOJ intervention, the average 100-pip daily range can easily triple. Additionally, at the exact time of intervention, USD/JPY had skyrocketed 100 pips in a matter of minutes.

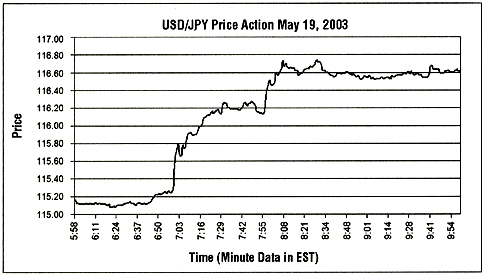

In the first case study shown below, the Japanese government came into the market, bought US dollars and sold 1.04 trillion yen (approximately US $9 billion) on May 19, 2003. The intervention happened around 7:00 am EST. Prior to the intervention, USD/JPY was trading around 115.20. When intervention occurred at 7:00 am, prices jumped 30 pips in one minute. By 7:30, USD/JPY was a full 100 pips higher. At 2:30 pm EST, USD/JPY was 220 pips higher. Intervention generally results in anywhere between 100- and 200-pip movements. Trading on the side of intervention can be very profitable (though risky), even if prices end up reversing.

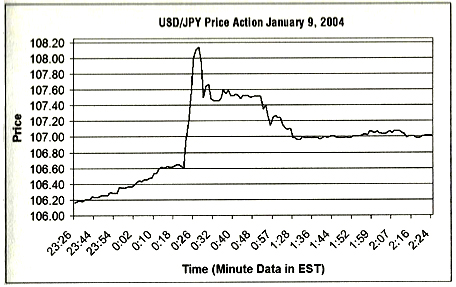

The second USD/JPY example, shown below, shows how a trader could still be on the side of intervention and profit even though prices reversed later in the day. On January 9, 2004, the Japanese government came into the market to buy dollars and sell 1.664 trillion yen (approximately US $15 billion). Prior to the intervention, USD/JPY was trading at approximately 106.60. When the BOJ came into the market at 12:22 am EST, prices jumped 35 pips. Three minutes later, USD/JPY was 100 pips higher. Five minutes later, USD/JPY peaked 150 pips above the pre-intervention level. A half hour afterward, USD/JPY was still 100 pips above the 12:22 am price of USD/JPY. Although prices eventually traded back down to 106.60, for those watching the markets, going in the same direction at the time of intervention still would have been profitable.

The key is not to be greedy, because USD/JPY could have very well reversed if the market believed that fundamentals really warranted a stronger yen and weaker dollar (as in this case), and that the Japanese government was simply slowing an inevitable decline or fighting a losing battle. Committing to take a solid 100-pip profit (of a 150- to 200-pip move) or using a very short-term intraday trailing stop of 15 to 20 pips, for example, can help lock in profits.

The last example of Japanese intervention was from November 19, 2003 when the Bank of Japan sold dollars and bought 948 billion yen (approximately US $8 billion). Before intervention, USD/JPY was trading around 107.90 and had dipped down to 107.65. When the BOJ came into the markets at 4:45 am EST, USD/JPY jumped 40 pips in under a minute. Ten minutes later, USD/JPY as trading at 100 pips higher at 108.65. Twenty minutes following intervention, USD/JPY was trading 150 pips higher then pre-intervention levels.

Eurozone

Japan is not the only major country to have intervened in its currency in recent years. The central bank of the Eurozone also came into the market to buy euros in 2000, when the single currency depreciated from 90 cents to 84 cents. In January 1999, when the euro was first launched, it was valued at 1.17 against the US Dollar. Due to the sharp slide, the European Central Bank (ECB) convinced the United States, Japan, the United Kingdom, and Canada to join it in coordinated intervention to prop up the euro for the first time ever. The Eurozone felt concerned that the market was lacking confidence in its new currency but also feared that the slide in the currency was increasing the cost of the region’s oil imports. With energy prices hitting 10-year highs at the time, Europe’s heavy dependence on oil imports necessitated a stronger currency.

The United States agreed to intervention because buying euros and selling dollars would help to boost the value of European imports and aid in the funding of an already growing US trade deficit. Tokyo joined in the intervention because it was becoming concerned that the weaker euro was posing a threat to Japan’s own exports. Although the ECB did not release details on the magnitude of its intervention, the Federal Reserve reported having purchased 1.5 billion euros against the dollar on behalf of the ECB. Even though the actual intervention itself caught the market by surprise, the ECB gave good warning to the market with numerous bouts of verbal support from the ECB and European Union officials. For trading purposes, this would have given traders an opportunity to buy euros in anticipation of intervention, or to avoid shorting the EUR/USD.

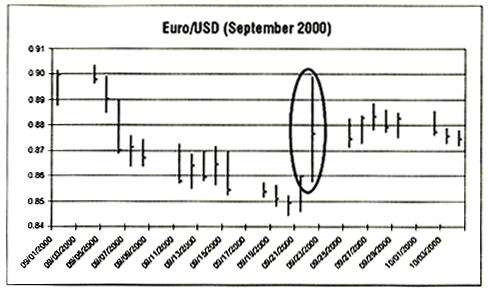

The chart below shows the price action of the EUR/USD on the day of intervention. Unfortunately, there is not minute data available dating back to September 2000, but from the daily chart we can see that on the day that ECB intervened in the euro (September 22, 2000), with the help of its trade partners, the EUR/USD had a high-low range of more than 400 pips.

Even though intervention does not happen often, it is a very important fundamental trading strategy because each time it occurs, price movements are substantial.

For traders, intervention has three major implications for trading:

- Play Intervention. Use concerted warnings from central bank officials as a signal for possible intervention – the invisible floor created by the Japanese government has given USD/JPY bulls plenty of opportunity to pick short-term bottoms.

- Avoid trades that would fade intervention. There will always be contrarians among us, but fading intervention, though sometimes profitable, entails a significant amount of risk. One bout of intervention by a central bank could easily trigger a sharp 100- to 150-pip move (or more) in the currency pair, taking out stop orders and exacerbating the move.

- Use stops when intervention is a risk. With the 24-hour nature of the market, intervention can occur at any time of the day. Although stops should always be entered into the trading platform immediately after the entry order is triggered, having stops in place is even more important when intervention is a major risk.