Filter Your Entry

By: Darrell Jobman

The following is an excerpt from Darrell Jobman's Profitable Trading the Turtle Way

We emphasize that the basic Turtle system is pretty simple and easy to follow, but our entry rules do indicate two additional filters in an attempt to increase our odds of success.

Filter #1: The first filter deals with the general concept that markets move in alternating periods of trending and consolidation, first seeking a new and fair equilibrium price level and remaining there until something new happens to change things. Because of this tendency, we would expect to see a “good” trend followed by some period of sideways consolidation, as opposed to another good trend coming back to back.

Therefore, we use a principle called the “last theoretical trade” or the “last trade loser” rule, also known as the “P/L Filter.” Basically, this says that if the previous trade in a given market was a winner, then you should not take the next breakout that occurs in the opposite direction. Remember, as trend followers, if our last trade was profitable, it was because the market was trending. Our reasoning here is that the next breakout in the other direction will likely fail, and the market will fall back into its old consolidation range rather than establish a newly emerging trend so quickly on the heels of the previous move.

This powerful concept helps to avoid trades that do not offer much chance of profit. In the world of computers, a large number of trades qualify under the breakout rules. For a trade to take all of them is not economically efficient. Many traders may not have sufficient money in their accounts to take every breakout. Even if this is not a problem, it may be difficult to keep track of too many simultaneous trades.

More importantly, taking every breakout is an inferior method of trading. If you could eliminate some trades while not reducing your total profits, you would have a better system. What is better: making $100,000 per year with 100 trades, or making the same amount with 70 trades? Aside from the obvious savings in commissions and execution costs, the second system is more efficient in that it makes more money on a per-trade basis.

The P/L Filter is designed to eliminate approximately 30% of the total number of signals generated each year without any corresponding reduction in profits. This is possible because the filter will eliminate trades that either have a lower probability of working or are likely to have a lower payoff than the trades that do work. Home run trades are rare enough to begin with, and it is extremely unlikely that a trade that is not P/L-selected will generate a huge profit. Honoring the P/L rule may occasionally mean you miss a large move, but overall, it will keep you out of enough bad trades to more than compensate for possible missed opportunities.

Just to simply state this important rule again, the P/L rule is that trades that present themselves after profits are less likely to work because the market will rarely go straight up and then straight down in sequential trends. Much more likely is the scenario of alternating periods of trends and consolidation. In other words, after a nice trend you should expect a period of consolation rather than another nice trend.

Applying this rule to our charts is done by visual examination. We simply look at alternating four-week breakouts on a weekly price chart (four weeks correlates with the 21 days to enter parameter). For our purposes, all four-week breakouts will always alternate in direction, and each new four-week breakout will signal the end of the trade generated by the prior breakout. Also, we only focus on trades that could have been made at these breakout points rather than trades actually made – therefore, the name “last theoretical trade” for this principle.

Filter #2: The second filter, which we use for forex markets, addresses the fact that these markets trade 24/7. Because of this, even though these markets trend well, there is a lot more backing and filling and increased overall “choppiness”. To compensate for this choppiness, we need something that provides additional confirmation that the long-term trend is valid and strong.

We do this by requiring that all of the signals we take also meet an additional condition: The market must be above (for long trades) or below (for short trades) its own simple 150-day moving average of closing prices. Although not a requirement in futures markets in the original Turtle system, this rule improves our performance in forex.

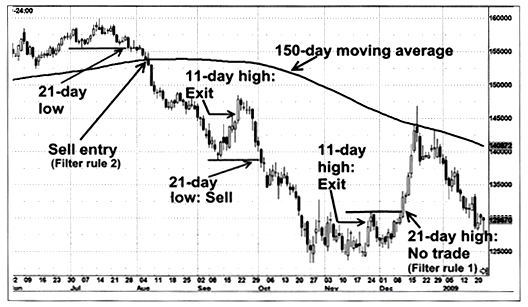

The euro chart below shows examples of both filters. On the first trade on the left side of the chart, the euro drops below the low of the last 21 days, but the price is still above the 150-day moving average. The short entry comes when the euro drops below the 150-day moving average.

On the second trade on the right side of the chart, a short position in the euro would have been exited when the high exceeded the high of the last 11 days. Then the euro rallies above the high of the last 21 days, but this signal did not pass either filter for establishing a long position; The P/L Filter rule prevented a long entry on the rally after the previous winning trade, and the market was well below the 150-day moving average. This may keep you out of a profitable trade, but a higher success rate overall compensates for missing some trades like this one.