Gaps - How They Fill

By: Chris Verhaegh

The following is an excerpt from Chris Verhaegh's The PULSE System

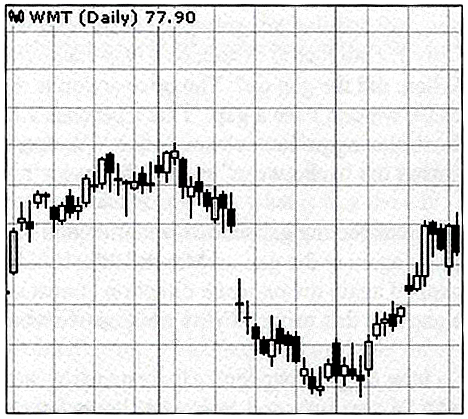

What do I mean by a gap? Below is a great chart that shows gaps and how they fill. Notice how the price “gaps” down between Sept 10 and Sept 11. Then, only a few days later, the price reverted back and “filled” the gap. Meaning the price came back to where it was before the gap. If we see a gap up, instead of a gap down, then that gap is filled when the price comes back down to where it was before the gap.

Not all gaps fare as neat and tidy as the one on this chart. Some gaps may take months or even years to fill! In very rare cases, like a buyout or a bankruptcy, some gaps never get filled. As a general rule, though, most gaps fill over time. The way to play them is to buy an option in the opposite direction of the gap.

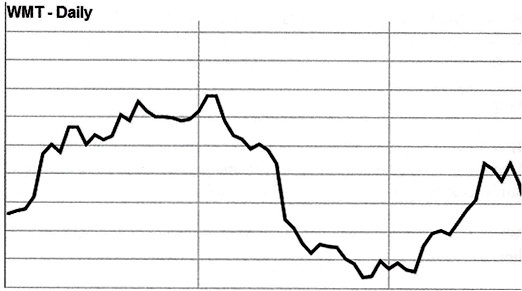

Now let’s look at the same chart, same time frame, only in Solid Line form instead of candlestick form. Where did the gap go? The price action is the same, but on a Line chart, we don’t see a gap. That’s because a Line chart only tracks from closing price to closing price. We don’t get to see what happened during the “in between” times – from closing bell to closing bell.

When expecting gaps to fill, we often don’t favor the short time frame. Look again at the gap in mid March; it didn’t fill until the stock gapped again in the opposite direction almost a month later. If we played a gap like this using Weekly options, we would be disappointed.

So how do gaps happen? Understand the stock market opens at 9:30 AM EST and closes 6 ½ hours later at 4:00 PM EST. The first trade of the day is known as the “opening trade”. The last trade of the day is known as the “closing trade”. Under normal circumstances, a stock should open for trading at roughly the same price where it closed the previous trading day. The key words in the last sentence are “normal circumstances”. Gaps are not normal. That’s whey we find them so important.

Normally stocks will start off where they left off. But in the case of a significant event like an Earnings release, there may be information in that event that changes people’s opinion of the stock dramatically. This new information may come as a shock to the market. After-hours sentiment then could drastically swing a stock’s price away from the closing price, so when the market opens in the morning that stock opens with a “gap” – up or down – from the previous night’s close.

Bad news may cause potential buyers to change their minds about buying. It could also change the minds of current owners about holding on to the stock. Good news may cause potential buyers to take action and it may calm current owners who had been considering selling. News, good or bad, can change everyone’s opinion. This changing of opinion can be so intense that bad news causes a stock to open much lower than its previous close: a gap down in price. Or this changing of opinion can be so intense that good news causes a stock to open much higher than its previous close: a gap up in price.

American holidays also present gap opportunities in world markets, because its’ often not a holiday in the rest of the world. So if there’s a price movement in the overseas markets during the holiday, the American market will likely open with a change to reflect the activity in the foreign market.

Since we’re talking about gaps… wouldn’t it be nice if we could plan on having a gap occur? Since gaps are caused by shocks to the market, where traders and investors no longer feel a stock is worth what it was the day before, wouldn’t it be nice is gaps were scheduled ahead of time? Well, I have some nice news for you… many are.

Technically, our calendars don’t tell us “Gap day scheduled for this day or that day”, but there are scheduled events that happen throughout the year with a high propensity for gaps. If you think about it, gaps are caused when traders and investors no longer feel a stock is worth what is was the day before (good or bad, higher or lower in price). What might make them feel otherwise? New information… especially new fundamental information.