Why Bear Markets Happen

By: Steve Swanson

The following is an excerpt from Steve Swanson's Market Turning Point Trading

Metaphorically, you could compare bull and bear trends to the seasonal variations of the earth’s annual journey around the sun. Each day the sun comes up in the east, and at high noon during summer months the full energy of the sun triggers very warm days. By contrast, during winter months, even at high noon, the mid-day sun seems to do little to alleviate bone chilling cold.

The difference between summer and winter temperatures is due to a small angle created when the earth is tipping either toward or away from the sun. A few degrees in one direction or the other creates a dramatic shift in temperatures.

Comparing it to the markets, bear markets don’t need dramatic changes in conditions to start dropping stock prices. In fact, it only takes a few small increases in interest rates to turn a bull market to bear.

When a bear market is upon us, stock prices drop like the temperatures in a freezing wind. Even hot stocks can barely move their own needle when broader markets are falling. Investors can then choose to either avoid the markets altogether, or they can consider trading in the other hemisphere where down actually means up.

When markets are falling, there are securities that are designed to rise in bullish fashion. We’re talking about PUT options on stocks, which increase in value when stocks are trending down, or INVERSE ETF’s, which are actually stocks that also move up when markets move down.

The worst possible move action for an investor during a bear market is inaction. Holding on to stocks during such times means being exposed to ever increasing losses as individual stocks fall like rocks in an avalanche with the broader markets.

We never want to get caught in such a sweeping slide, so let’s examine some reasons why bull and bear tends will develop. A question I am often asked is, “When will this bull market end?” Fortunately, I found the answer to that question early on in my investing career, and that knowledge paved the way for a very comfortable lifestyle.

Here’s the short answer: Bull markets end when there’s a better opportunity to earn higher and safer returns than in the markets. In simple terms, a Bull trend ends when interest rates are raised enough to force money out of the markets and into guaranteed instruments.

For most investors, the connection between bull/bear markets and interest rates is not so obvious. Studies going back to the late 1800’s show a clear correlation between the rise and fall of interest rates and longer term bull and bear markets. The upshot is when interest rates are falling or especially low, markets are highly likely to be bullish with strong rallies and only minor corrections. Alternatively, when interest rates are rising, markets begin to stall and experience failed rallies at key resistance levels, and bearishly reverse with increasingly stronger sell-offs.

But, here is something else those interest rate studies revealed. When certain thresholds were exceeded, very dramatic reversals occurred in the stock market’s direction. That finding applies to both bull and bear markets. To understand the “threshold” implication, let’s examine interest rates as they apply to investing.

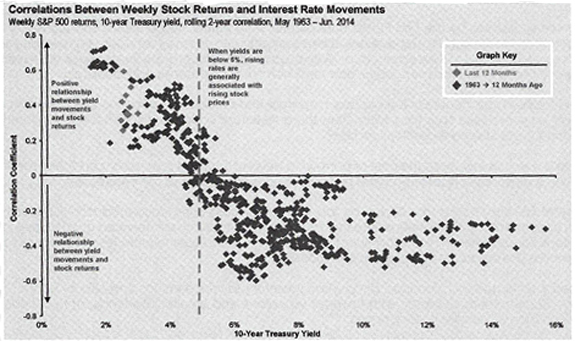

The chart below shows an important relationship between interest rates (10 yr Treasury yield) and the value of the S&P 500 (since 1963). The chart demonstrates a market truism: While rates are low, as defined below five percent, markets will be in the bullish to very bullish range. Rates below two percent show the highest correlation to bullish stock prices.

When interest rates increase, bull markets begin to taper off. As yields exceed the five percent threshold, the chart indicates bearish prices for the markets will begin. At 6.5% or greater yield, markets should remain in a fully bearish condition.